Paid Social Manager Chloe Bratherton dives into what makes an omnichannel marketing campaign a success, from working with algorithms and audiences to the importance of nailing your creative assets.

One of the best — and also trickiest — things about working in marketing is that it constantly evolves alongside consumer behaviour.

These days, we’re far more likely to use multiple devices simultaneously, with 40% of adults in the UK starting an activity on one device and finishing on another. It makes sense that modern marketing campaigns must expand to cover new channels.

But when you plan channel activity in silos, the result can feel disjointed and confusing to consumers. It also makes measurement and testing at a campaign level nearly impossible, making it tough to move marketing strategies forward.

The good news is that omnichannel solutions to this issue are popping up more frequently than ever before. But while those solutions can help you execute the technical details of your plan, they still require a shift in your mindset. You need to think omnichannel when planning your campaigns to get the most out of them, both in measurement and in return.

Luckily, we have plenty of experience crafting omnichannel strategies for our clients. Below, I’ve listed all the best tips I’ve learned in my time — and what I’m still learning today!

The first step when planning any campaign is formalising the campaign’s KPIs. This way, everyone involved knows the common goal they’re working towards.

Being able to translate business goals into balanced media plans with achievable and clear KPIs builds the foundation for the rest of the campaign plan. It also helps inform how you’ll use your budget across the buying funnel, especially if your campaign has split objectives.

Budget can also inform the optimal audience size if you use an average cost per thousand impressions (CPM) to calculate a rough estimate of impressions.

Here’s how to calculate it:

(Budget/CPM)*1000 = Estimated number of impressions for the campaign

Once you have this figure, you can use the frequency benchmarks (fig 1) for the campaign objectives to find the estimated reach of the campaign.

Impressions/frequency benchmark = Estimated reach

NOTE: This figure is an estimate. It uses CPM averages from multiple channels, which can have CPMs ranging from £5 to £30+, so you may need to adjust it after channel selection.

The proportion of budget used on each channel will differ with each campaign, but this method is a great ballpark to start audience planning when working with audiences sized in multiple millions.

Modern algorithms are incredibly intelligent. But here’s the catch: they usually only excel at one thing, which comes at the cost of other metrics.

If you want to make the most of algorithms without falling victim to their limitations, I recommend using a reach estimate. Your reach estimate will give you the rough number of individuals or devices you expect to see in your campaign. It’s worth running a reach estimate for each part of your marketing funnel.

A campaign optimised for video view-through rate (the average percentage of a video watched) will almost always have a lower click-through rate than a campaign optimised for traffic. We’ve all had campaign briefs that must hit multiple business goals; I always split these into separate campaigns.

All inventory has specific strengths and weaknesses. You can offset these by using a channel that can compensate.

Source: The Trade Desk

Planning is usually far more complicated when using many partners across each inventory type. These campaigns cannot consider the potential overlap of the audiences between channels, which means you’ll struggle to control how often consumers see your ads while the campaign is live.

By planning and buying an audience rather than a specific inventory, you can track this audience across multiple media channels. You can also manage how often the audience sees ads at a campaign level rather than an inventory level, reducing wastage and making the journey more seamless for the consumer. Win-win!

With the continued loss of the cookie and the focus on contextual targeting and first-party data, reaching the right audience has become even more difficult.

Literally billions of impressions are available daily. But only a fraction of of them will be relevant for your brand. Audience planning is key to ensuring your marketing budget reaches consumers who want to buy from you.

When defining an audience, it is crucial to be aware of bias. Biases can carry over into your targeting, potentially restricting your available audience.

To counter this, focus on the vertical and demographic data. The initial parameters can give a good first read on the channels and digital touch points which align with the audience.

From there, build a few audiences: one which uses first-party data to build lookalikes and one or two which use different contextual targeting signals to inform potential audiences.

Here’s how:

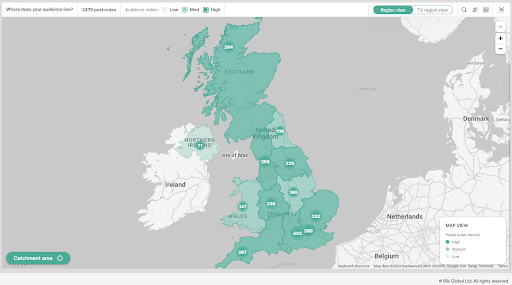

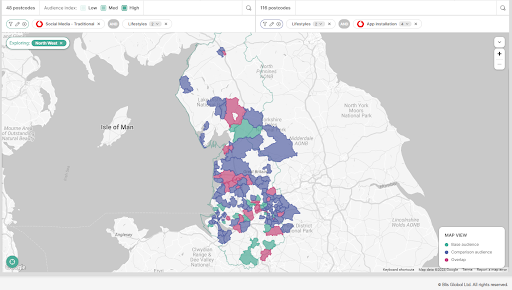

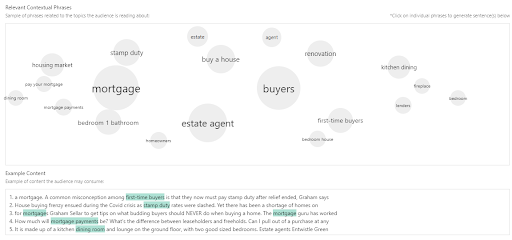

Source: Blis

Source: Blis

Remember: don’t be too rigid with your audience definitions. The more intuitive you allow the targeting algorithm to be, the more likely you’ll find unexpected audience insights. These new insights are super valuable because they can help you improve your future campaigns.

Here’s an example from one of my client campaigns. When I recently ran a campaign targeting home movers, audience insight showed they were also much more likely to be in the market for buying curtains and blinds. So, I created an audience segment of people who were in the market for buying curtains.

Lo and behold, it was one of the top performers, beating out the audience of those who had spent time on Rightmove/Zoopla (everyone knows someone who browses properties for fun, right?). These insights secured more investment from the client to scale up the campaign.

Once you’ve locked in your target audience, the data will point you toward the best channels to use to reach them.

Imagine you have the following information about your audience:

With this information, you understand how the audience spends their time, which tells you how AND when to reach them with your ads.

Source: Blis

With the information about public transport, you can focus your digital out-of-home (DOOH) activity on bus shelters near commuter hubs and city centre sites. Knowing how your audience interacts with apps helps determine which inventory resonates with them best.

You can also figure out the best medium by time of day. For example, if you serve an audio ad during a workout, then it is unlikely your audience will see any imagery. But if they’re commuting by train or bus, they’ll usually have more opportunities to look at their phone; in this case, display or video ads might be the better choice.

You should also look at web domain insights for your audience. These lists usually contain hundreds of sites the audience uses, so it is best to look for themes in content types here. Just be aware that some partners will only give contextual insights rather than complete domain lists.

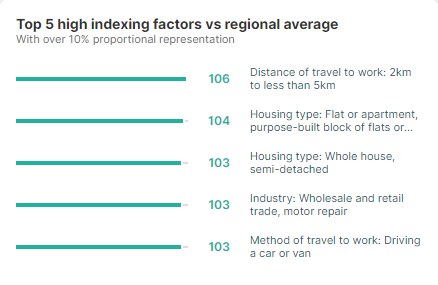

Most audiences will have some coverage across all inventory types. Use your campaign KPIs to refine the channel selection; this helps to focus your budget on key channels to hit your KPIs more efficiently (most channels do roughly slot in at some point along the buying funnel).

Source: Bring Digital

If you’re running a sales-based campaign, focusing on display, high impact display and potentially native to drive sales volume while running an upper- to mid-funnel video and audio (fig 5) campaign to provide scale and sound on environments to prolong ad stock would then reduce the inventory types to those which align with the campaign KPIs.

Once the channel selection is defined, it’s time to transform the plan into a physical campaign. If using audience insight data from YouGov, another supplier or internal data, this will need to be translated for each partner, using data targeting available to build your planned audience.

Any demographic data unimportant to the business — such as “car ownership” for consumer goods or “home ownership” for fashion — can be left out to allow the algorithms more room to flex.

When building audiences, there are some core types you should use wherever possible:

While using high-quality data should be your focus, each partner will have different data partnerships and targeting capabilities. Knowing your partners’ USPs will help you decide which is most likely to ensure success in your next campaign.

Source: Stack Adapt

In 2024, the majority of serious suppliers in the programmatic space offer inventory across several channels, the most common being:

The potential inventory available within each channel is based on each partner’s connections. It often impacts partner selection even more than the channels available.

Today, most partners have access to a wide range of channel inventory. There’s significant overlap in partner inventory, with many offering vast amounts of high-quality inventory space across each channel. This won’t thin the pool too much unless you are looking for niche inventory.

The critical differences between partners usually revolve around technology:

A campaign measured on brand-led results should use partners who can give you additional value in this area.

Think of a CTV incremental reach study and a brand lift study, and campaigns measured against sales would benefit from a search uplift or a conversion lift (fig 7).

These additional measurement solutions are key for omnichannel campaigns as they help to unpick the complicated consumer journey and prove the impact a campaign or channel has had on wider business performance.

Source: Medium

The final piece of the puzzle is your creative assets. After audience targeting, creativity is the most important factor in ensuring a successful campaign. Getting the ad in front of the right people is step one, but getting them to look or even listen is far more challenging..

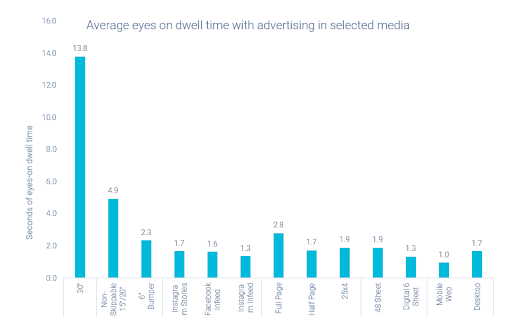

It’s crucial to consider the frame of mind of the consumer when briefing in creative. Consider the context of each touchpoint within the journey and the very limited amount of time available to grab the attention (fig 8) of the consumer when mapping out their mindset.

Source: Lumen Research

Creative needs to align to the campaign message, but requirements and best practice differ for each channel:

There are plenty of partners who can offer support on converting creatives to different formats to make them work for each inventory type making it easier to test new channels without a big creative investment.

Once the campaign is live, the audience and channel insights will start rolling in, by buying an audience across multiple channels, you will get insight as to how each channel performs for each audience, as well as the overall results by channel and by audience, deduplicated by partner.

Marketers in the programmatic space know that comparing partners and audiences on single-channel inventory can be incredibly difficult thanks to an endless variety of measurement and attribution metrics.

As more and more suppliers expand their inventory, a greater range and higher quality inventory become available, similar to how exchanges first started popping up in the early 2000s, but with the added complexity of the modern purchase journey factored in.

There’s a lot to digest here, so here’s a quick recap:

Want to learn more about omnichannel marketing? You can tell us about your project using the contact form or by calling 0161 4410895.